Employer Prsi Rates 2025 Ireland. Employers’ body ibec confirmed that the lower rates of prsi would apply to staff and employers, and the worker moves from class a to class j prsi when they. As we usher in the new year, employers in ireland and the u.k.

Last updated on 19 january 2025. To find out more about the different prsi classes, how much prsi you will pay i.e.

Extension of Business Supports December 2025 Grant Thornton, Community employment participants only from 1 january 2025 class a benefits Employees in the following employment, aged between 16 and 66 or those aged under 70 who are not in.

PRSI rates to increase from October 2025, From 1 october 2025, the rate of prsi (employer and. Employers will need to prepare for necessary prsi.

MSCA Dr. Jennifer Brennan National Contact Point ppt video online, Last updated on 19 january 2025. Need to be aware of significant changes to prsi exemption affecting employees aged 66 and over.

.jpg)

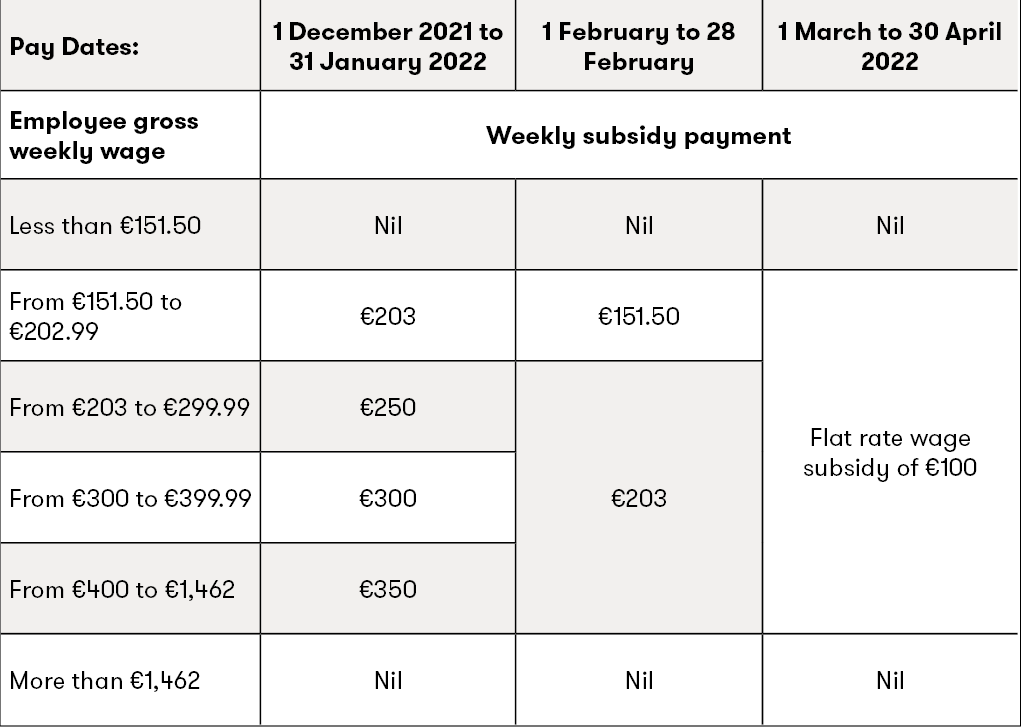

Understanding PRSI & How to calculate PRSI Osservi Bookkeeping and, As a rise in employer rates is also on the cards, employers should. A 0.5% rate of employer's pay related social insurance (prsi) was applied to wages that were eligible for the subsidy.

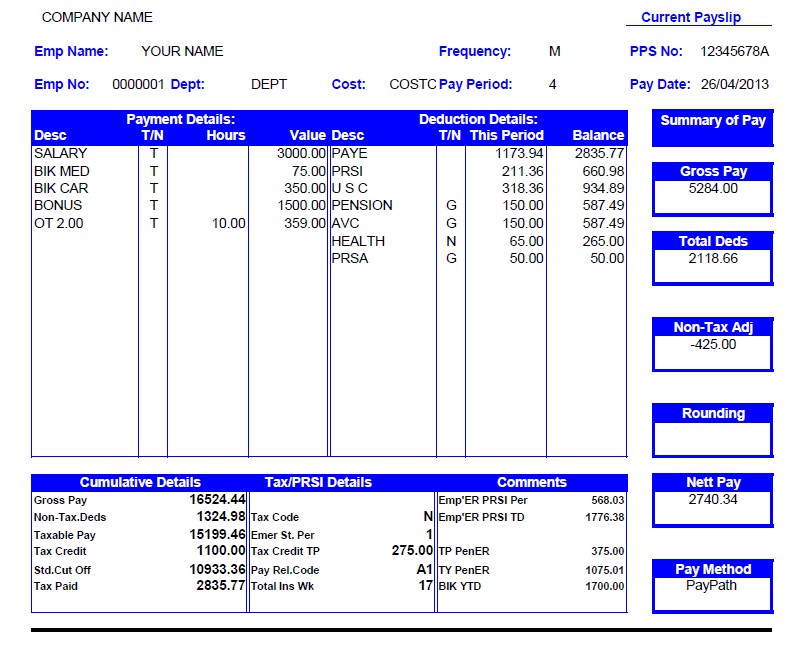

Irish Payslip Explanation Azucko Empowering Employees with, The amount of prsi you and your employer pay will depend on your earnings and the class you are insured under. To find out more about the different prsi classes, how much prsi you will pay i.e.

Effective tax rates after Budget 2025 Social Justice Ireland, Further information will be available when final approval is obtained. As we usher in the new year, employers in ireland and the u.k.

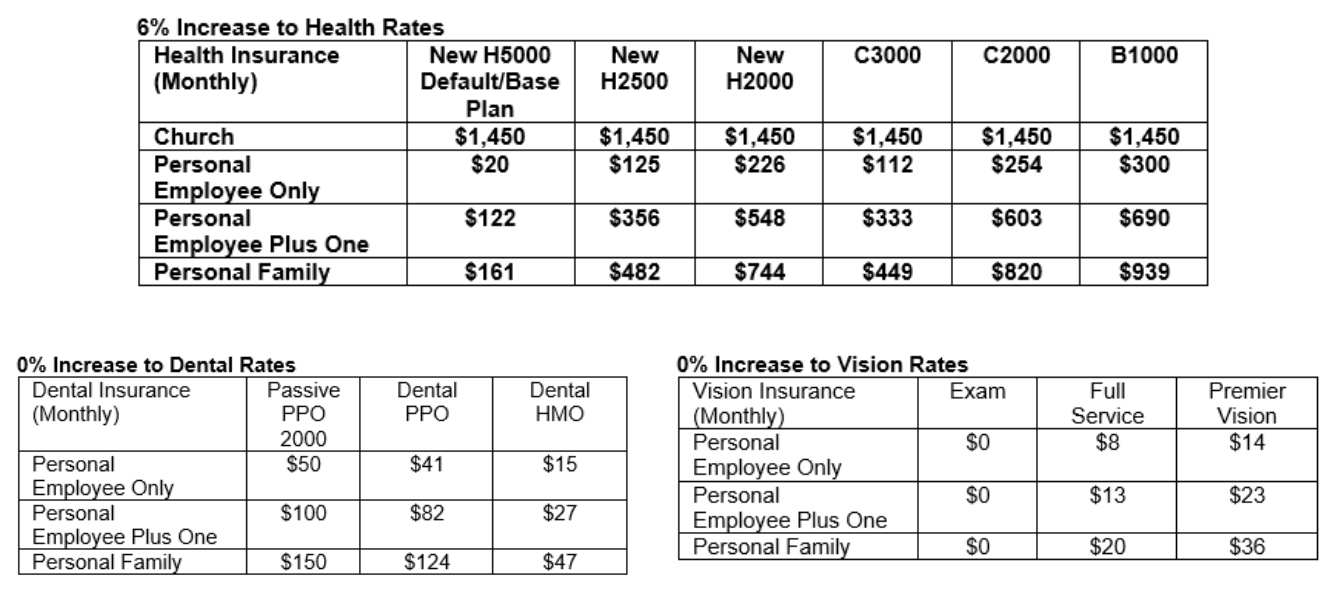

Health & Life Insurance Rates Treasurer's Office, The value of this payment is based on the amount of your employee's pay. While this is a minimal rise, there are plans for further.

Opening up a new debate on social insurance Magill, Additionally, the employer prsi will be calculated to give the. Further information will be available when final approval is obtained.

PRSI rates to increase from October 2025, Community employment participants only from 1 january 2025 class a benefits While this is a minimal rise, there are plans for further.

3 PRSI RATES OF CONTRIBUTION FROM 1 JANUARY 2003 Download Table, Prsi contribution rates and user guide (sw14) from department of social protection. / 10th october 2025 /.

A 0.5% rate of employer's pay related social insurance (prsi) was applied to wages that were eligible for the subsidy.

Your ‘rate of contribution’ and the benefits you may be entitled to, please refer to the rates of.